High Dividend Stock Yields 9%, With Healthy Tailwinds

Summary

This stock yields 8.7%.

It's a leader in its food industry niche, supported by healthier eating trends on a global basis.

Management raised dividends by 49% in 2017.

This idea was discussed in more depth with members of my private investing community, Hidden Dividend Stocks Plus.

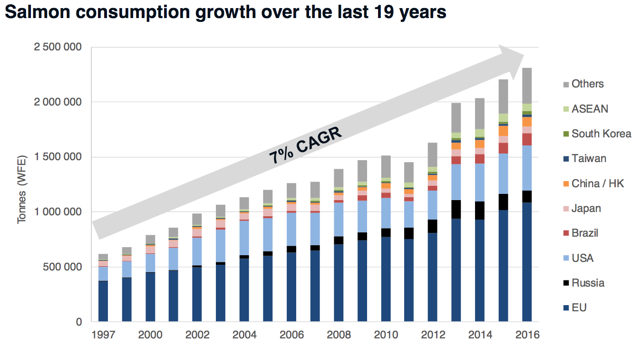

"Teach a man to fish, and you'll feed him for a lifetime." In the case of Marine Harvest Group ("MHG") (OTCPK:MHGVY), that old adage has been taken one major step further. Instead of fishing for profits, MHG grows its own salmon. In fact, it's the world's leading supplier of salmon, a healthy protein which has seen its consumption grow by 7%/year from 1997 to 2016:

(Source: MHG site)

Global consumption also has increased in 2017 - it was up 6% in the third quarter, with the US up 11% and Asia up 18%.

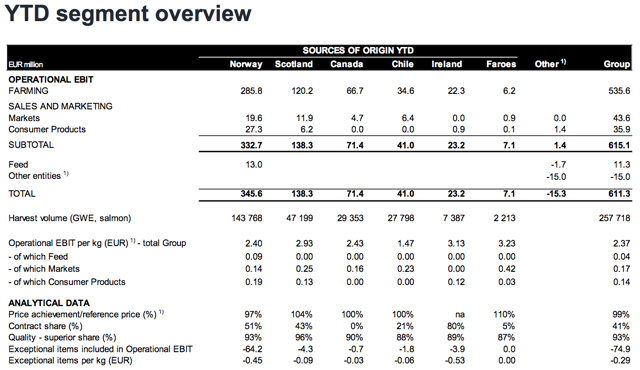

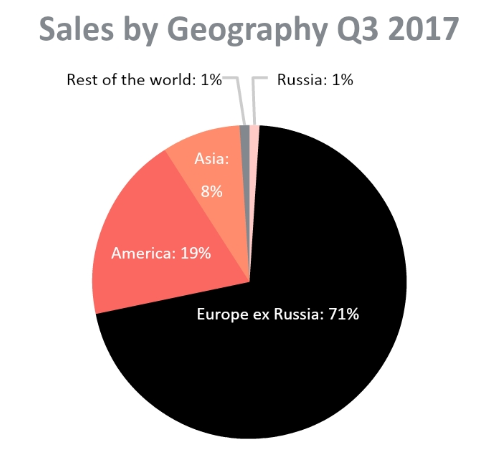

Although other areas have seen better growth in demand, Europe remains MHG's biggest sales area:

(Source: MHG site)

The company has salmon farms and operations in several countries, including Norway, Scotland, Canada, Chile, Ireland, the Faroe Islands, and it owns the upscale Ducktrap River brand and operations in the US. Norway is the leading segment for EBIT, with 57% of Operational EBIT in Q1-Q3 2017, followed by Scotland with 23%, Canada with 12%, Chile with 7%, Ireland with 4% and the Faroes with 1%:

(Source: MHG site)

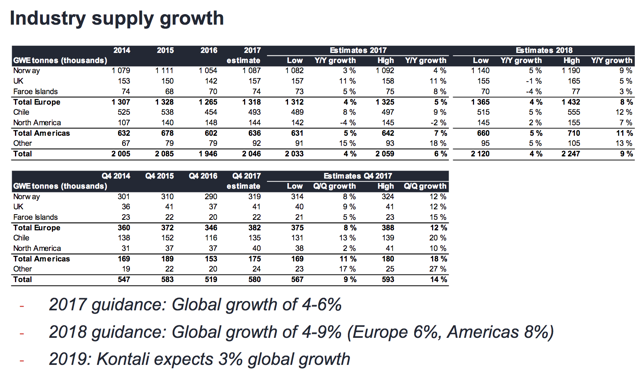

Salmon supplies are expected to grow 4-9% in 2018, but only 3% in 2019, which would most likely lead to higher prices as markets tighten. MHG saw higher prices in Q4 '16, which led to its record performance that quarter.

(Source: MHG site)

Fresh bulk salmon was 41% of Q3 sales, while smoked/marinated and processed salmon was 47%.

Where and How To Buy

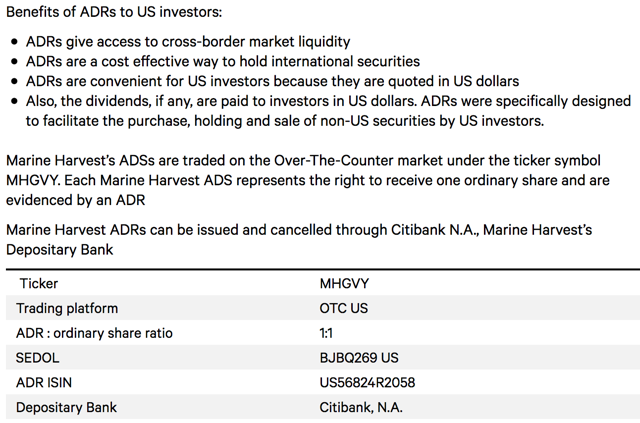

MHGVY trades in the US as an ADR on the OTC/Pink Sheets. It has good daily trading volume in the US, averaging ~69,000 shares daily. You can also buy it on the Oslo Bors, under the ticker MHG, via some US brokers, such as Schwab, who will charge you a ~$100 brokerage fee, plus a smaller fee for the overseas broker. It can pay to call up your broker's overseas desk and compare the overseas price to the US OTC price. The share volume in Oslo is in the millions.

(Source: MHG site)

Dividends

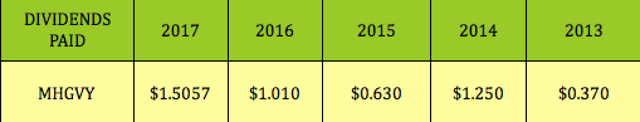

MHG pays a variable dividend due to the fluctuations of its market. Here's its yearly payout history, in US dollars. The company declared another $.41/share payout in November 2017 - its 2017 payouts jumped by 49%.

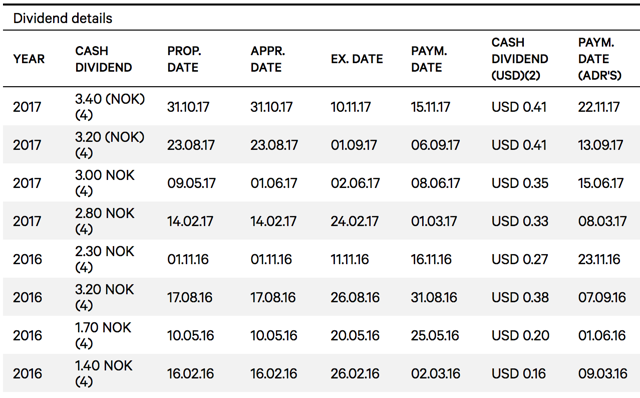

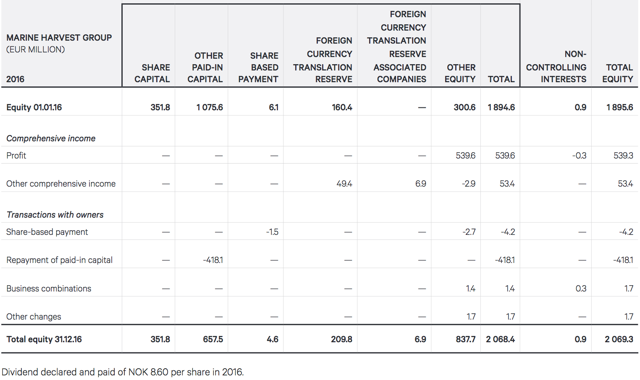

The MHGVY ADRs pay approximately a week later than the Oslo-based shares, in a March-June-September-November cycle. Management has listed the dividends paid as a "repayment of paid in capital," which allows US investors to avoid the 15% Norwegian withholding tax. However, this will decrease your cost basis and increase your taxable profit if you sell your shares at some point:

(Source: MHG site)

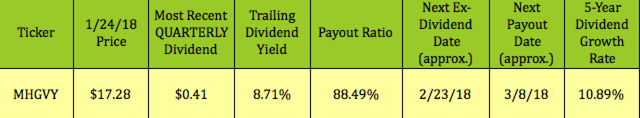

The company should go ex-dividend again in late February 2018. It yields 8.71% at a ~$17.28 price level:

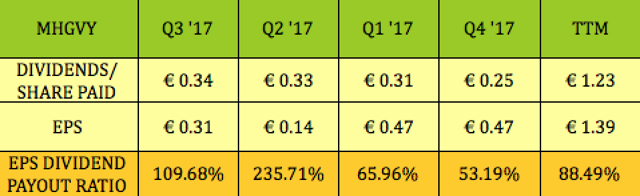

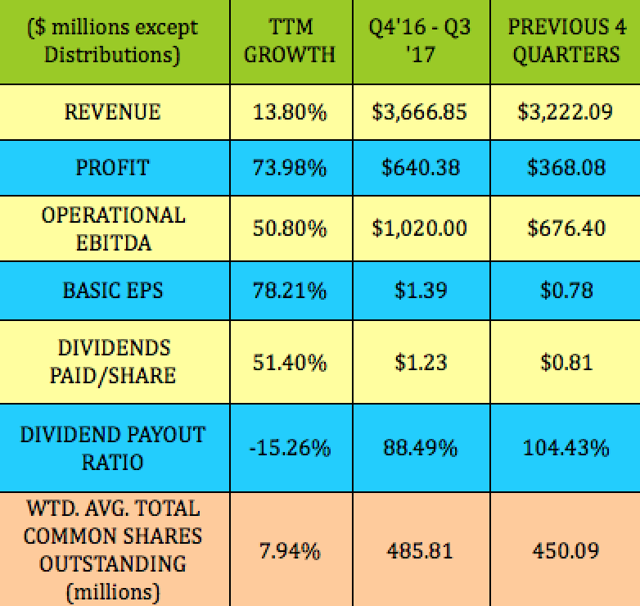

MHG's payout ratio jumps around each quarter - it has averaged 88.49% over the past four quarters on a traditional EPS/dividend basis, which includes non-cash depreciation and amortization:

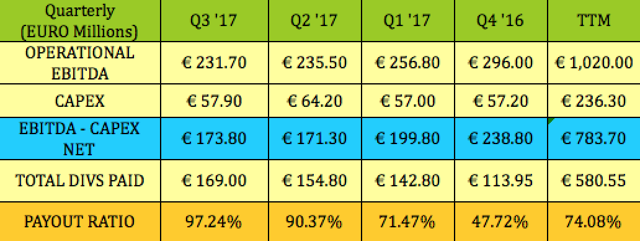

Deducting capex from operational EBITDA shows a payout ratio of 74.08%:

Earnings

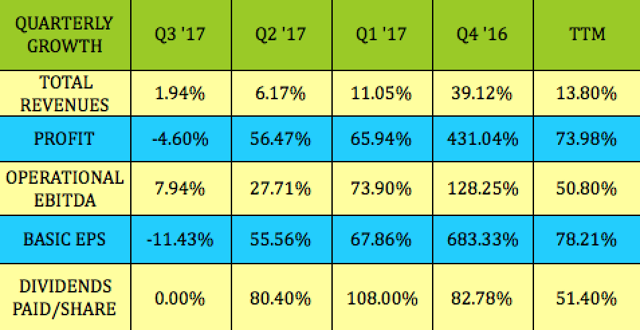

In Q3 '17, revenues were up ~2%, EBITDA grew ~8%, whereas profit and basic EPS declined. Dividends per share were consistent with those seen in Q3 '16.

Management said on the Q3 '17 earnings call that this was "the best third quarter in company history," with operational EBIT of $194 million, thanks to continued high prices, lower costs and strong demand.

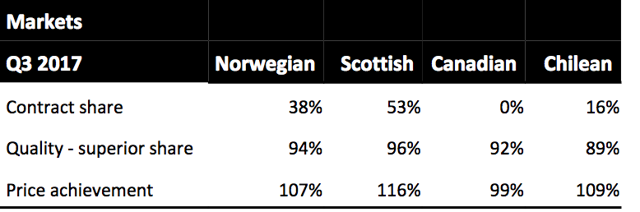

Even though prices were down year over year, they were still high historically, and MHG's operations were further supported by contract prices, which were 7% higher in Norway than spot prices overall - all of the company's segments, except Canada, achieved higher prices year over year. Increased demand and higher harvest volumes also supported earnings.

(Source: MHG site)

Management tends to spend more on capex in Q3, and Q4 tends to be its strongest quarter for consumer demand - Q4 '16 had company records in revenue and EBITDA. This bodes well for Q4 '17.

The past four quarters have had robust TTM growth in revenue, profit, EBITDA, EPS and dividends. The company also managed to improve its payout ratio by 15%, even with total share count rising by ~8%:

Growth Projects and Acquisitions

MHG is building a new feed plant in Scotland, which is expected to be operational in the second half of 2018.

It also has a joint venture investment in DESS Aquaculture Shipping, a fleet of four wellboats and one harvest vessel under construction.

In late December, MHG announced a deal to buy an east coast Canadian salmon producer, Northern Harvest. "The acquisition price on a cash and debt free basis is CAD 315 million, and the intention is that the consideration will be paid in cash using available credit lines under Marine Harvest's existing revolving credit facility. The company is expected to harvest 19 thousand tonnes (GWE) of salmon in 2018, and has currently 45 farming licenses in Newfoundland and New Brunswick. The company has an additional 13 farming licenses in application mode." (Source: MHG site)

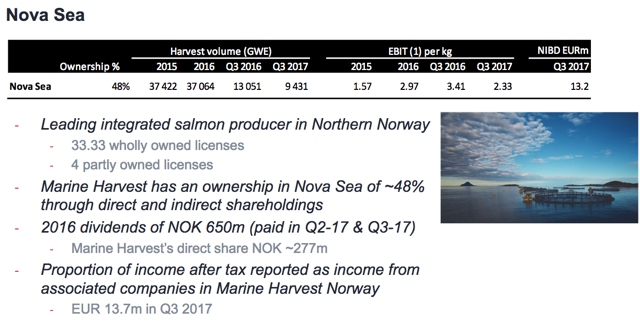

Management acquired 48% of Nova Sea, a large Norwegian salmon producer, in a deal which generated dividends of NOK 650 million in Q2 and Q3 '17. This resulted in 13.7 million euro in after-tax income in Q3 '17:

(Source: MHG site)

There's another ongoing issue, which, if it gets resolved, could be a big boon for MHG. For seven years, the Norwegian Food Safety Authority has been going back and forth with China, trying to restore salmon shipping to that country. In September '17, they said that they had responded to all of the inquiries from the Chinese authorities, and were awaiting an updated list of approved Norwegian salmon producers.

Risks

There's an approximate 5% dilution overhang of potentially 21.87 million shares from a convertible bond issue which matures in 11/5/20. The conversion price has a 35% premium at a fixed currency exchange rate, which equals 152.86 Norwegian Krone/share. As of 1/24/18, MHG was trading at a lower price of 136.35 NOK in Oslo, so it didn't make sense for bondholders to convert yet.

Currency exchange - As with any foreign holding, you'll gain diversification versus your US holdings. However, you'll also gain exposure to the Norwegian Krone - NOK - by holding MHGVY. We've always welcomed exposure to Norway, which has one of the most robust economies in the world. The Norwegian Krone has risen 7.4% versus the US dollars over the past year, as of 1/24/18.

Sea Lice and Mortality - MHG has battled these problems for years - the company had a particularly rough time with it in Chile, which also had an algal bloom problem. Fortunately, Chile seems to have turned a corner - its volume increased by 21% in Q3 '16. Mortality and lice mitigation cost the company's Norwegian operation ~25 million euro in Q3 '17.

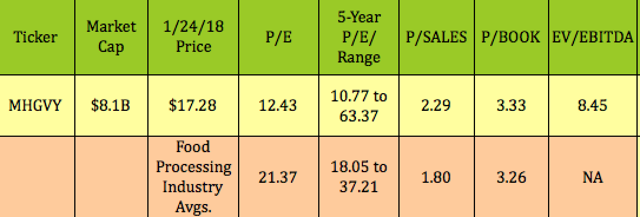

Valuations

At a price of $17.28, MHG has a P/E of 12.43, which is very close to the low end of its five-year range. It has higher price/book and price/sales valuations than broad industry averages.

Financials

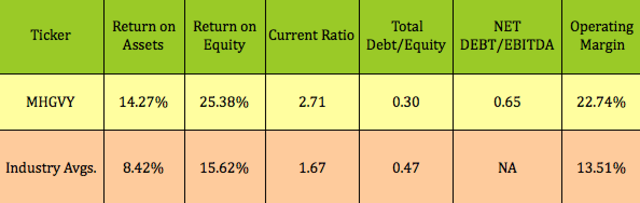

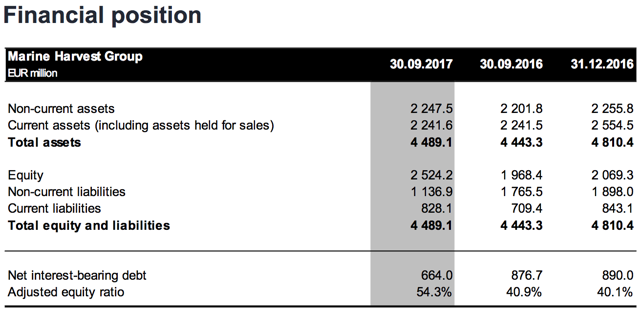

The company has very low leverage, with a sub-1x net debt/EBITDA ratio of .65 and a total debt/equity ratio of just .30. Its ROA, ROE and operating margin also all compare favorably with broad industry averages.

Debt and Liquidity

Management refinanced its bank facility in Q2 '17 and was compliant with its 35% debt/equity ratio as of 9/30/17. The new senior secured 1.206 million euro facility also has a 200 million euro accordion feature. The company has a 1.25 million NOK bond maturing.

On the Q3 earnings call, management said that "the financial position for Marine Harvest has never been better."

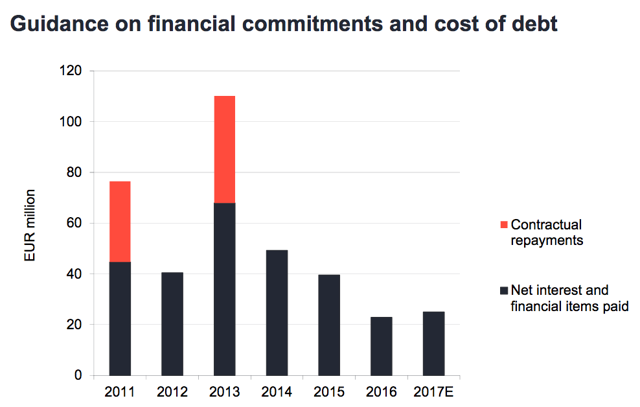

(Source: MHG site)

Net interest and financial items paid decreased significantly in 2016, but have increased in 2017. Management also is targeting a higher level of Net Interest Bearing Debt, NIBD, in order to fund growth, so we'll see MHG's interest expenses rise in 2018.

(Source: MHG site)

Summary

We rate MHGVY a long-term buy, based on its attractive yield, its dominance in a niche industry with significant tailwinds and its continuing earnings power.

All tables furnished by HiddenDividendStocksPlus, unless otherwise noted.

Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.

Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.

If you're interested in discovering other attractive income vehicles, we urge you to try a 2-week free trial period for our new service, Hidden Dividend Stocks Plus, on the Seeking Alpha Marketplace. Our service focuses on undervalued and undercovered dividend stocks and income vehicles, with yields ranging from 5% to 10%-plus

Disclosure: I am/we are long MHGVY.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We're also long MHGVY in client accounts